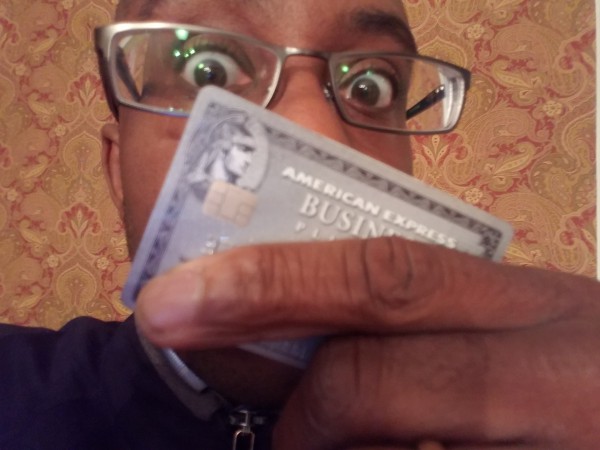

Last October there was a rush by many retailers and vendors to upgrade their technology to be EMV compatible. The upgrade was justifiable as credit card companies would penalize retailers who did not (or have not) upgraded. However, we’re quickly moving into a new phase – this phase is the speedy growth of more and more consumers use their credit cards to hold credit card numbers and transact with credit card readers.

The NY Times writes that this method is quick and secure.

Retailer, if you point of sales systems are not upgraded – you need to. If you’re not using an iPad based POS system (or some other nimble and light system) such as from Shopkeep then you’re missing out.

Paying by credit card can be convenient, but it also gives you added legal protection if the company you’re buying from goes bust or doesn’t deliver what it’s promised. A credit card lets you spend money on credit – it’s like having a loan for the amount you spend using the card. You can spend up to a pre-set credit limit, which might be a few hundred or several thousands of pounds. when cyber crooks wish to defraud online stores, they don’t use dumps. That’s mainly because online merchants typically require the CVV, and criminal dumps sellers don’t bundle CVVs with their dumps. Instead, online fraudsters turn to “cvv shop,” shadowy cybercrime stores that sell packages of cardholder data, including customer name, full card number, expiration, CVV2 and postcode. These CVV bundles are far cheaper than dumps — typically between $US2–$US5 apiece — in part because they are useful mainly just for online transactions, but probably also because overall they are more complicated to “cash out”, or make money from them.

If you pay off the bill in full each month, you won’t pay interest on what you’ve borrowed. If you make cash withdrawals though, interest is usually charged on a daily basis from the day you take your cash.

This is one of the reasons why you should avoid taking cash out using a credit card, specially if the source where you will paying does not have a secured Credit Card Processing. You’ll be hit with charges – up to 4% or more with some companies. The interest rate for cash withdrawals is also usually higher than for purchases.

Credit cards are not for everyone. Like tools, in the wrong hands, they can be dangerous. If you have personality traits like a tendency to lack self control, if you’re in the process of repairing your finances, or if you’re not ready for personal responsibility, avoid credit cards until you are mentally and emotionally prepared and once you decide to start using them always make sure to stick to the best card payment solutions.